Photo by Ashley Batz on Unsplash

*COVID-19: We are committed to helping our community through this crisis. To that end, our incredible portfolio companies have many materials and products to assist in this time of need, and we will be promoting them in this series. We’ll get through this together - read on and stay tuned.

By Principal Emi Gonzalez

The uncertainty of COVID-19 ignites fears of 2001 and 2009. How long will it last? What will be the impact? When will we recover?

In 2000, venture capitalists invested $50.5 billion in US startups. The next year, $25 billion. Funding for new innovations was cut in half. From 2008 to 2009, venture funding across all industries fell almost a third, to $27.4B.

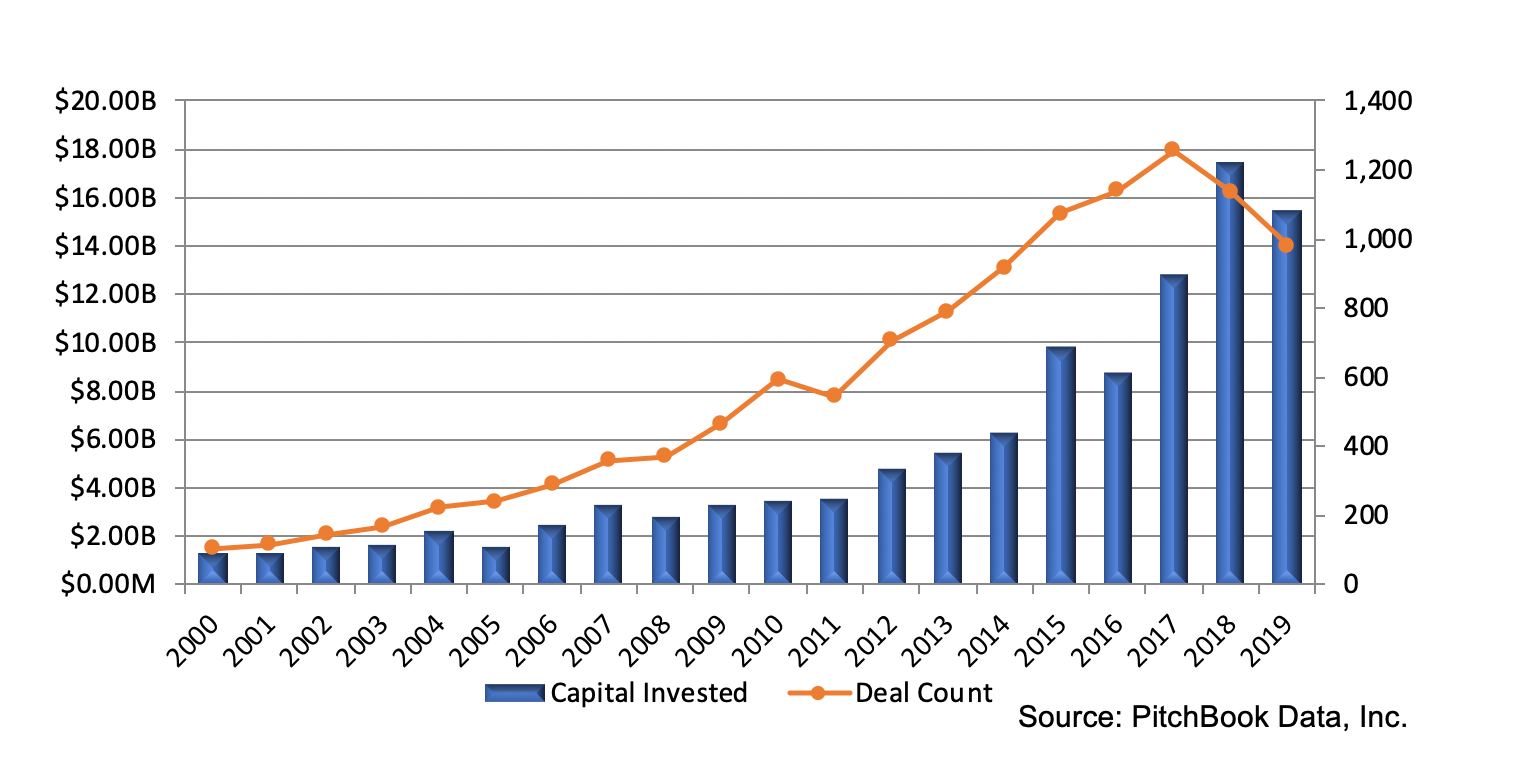

However, when markets fall ill, the healthcare sector—though not impervious—has proven to have a stronger immune system than others. Healthcare has grown more consistently over the past 20 years, and suffered much less when the overall economy deteriorates.

People always need drugs, diagnostics, and medical devices—more in times like today than any other. The aging population is a powerful secular trend. And healthcare innovation, from medical discoveries to digital health, is more robust than ever. So in times of recession, healthcare investing has been less affected than other industries.

The exceptionalism of healthcare is manifest in biotech. Venture capitalists invested the same in 2001 as in 2000, and 4 percent more in 2009 than 2008. Fewer websites and software services were funded, but most therapeutic development powered through. Positive trends in the rate of scientific discovery and the emergence of new biotechnologies have repeatedly outmatched macro factors to drive out performances.

COVID-19 poses a new challenge to the biotech industry. Quarantine and strained medical capacity have delayed clinical trials, interrupted manufacturing, and shut down labs across the world in the middle of experiments, threatening biomedical progress. Yet infectious disease endeavors have benefited. The beleaguered vaccine-maker Novavax ($NVAX) has seen its shares rise 250% in the three months since COVID-19 emerged; while its peer Inovio ($INO) was up over 300% on news of its experimental vaccine, before being marred with controversy. Other companies have fallen prey to the same risks that always plague biotech, like a critical patent defeat last month for Amarin ($AMRN), which dropped 70% overnight. Volatility is no stranger to biotech investors.

In private markets, venture funding remains robust, $2.41B in biotech deals were disclosed in March, exceeding deals in January or February with many deals closing even amidst growing awareness of COVID19, and higher than the top months of 2019.

Last month, leading biotech firms announced over $3B in new capital. ARCH Ventures, which rarely talks about its size, made an exception by disclosing $1.5B in new funds allocated for early-stage biotech, hoping to bolster community morale. Flagship Pioneering added a $1.1B fund to build on its existing portfolio of biomedical ventures and tools. VenBio added $394M to invest in therapeutics, its first new fund in almost 5 years. And other top biotech firms have raised even more new capital unannounced, as investors flee from other industries to the sector best positioned to confront a medical crisis.

COVID-19 has equally been an opportunity for the healthcare sector to demonstrate its critical value to society. Companies from young startups to pharmaceutical conglomerates are testing vaccines and the potential of repurposed drugs. Moderna launched phase II trials for its mRNA vaccine and received $483M of support from BARDA to accelerate development. Pfizer and BioNTech joined forces to launch a 7,600 person trial of four mRNA vaccine candidates to determine their safety, immunogenicity and optimal dose. E25Bio, a small biotech company in Cambridge, developed the first rapid antigen test for COVID-19 that delivers results within 15 minutes. Dynavax has made its adjuvant technology available to assist companies working on COVID-19 vaccines. The FDA, under the Coronavirus Treatment Acceleration Program, has promised to work with companies to catalyze the development of new therapies, though the response has been mixed. AbbVie committed $35M in a COVID-19 relief package that includes contributing to the International Medical Corps, which is building 20 field hospitals to help overburdened clinics. Pfizer announced $40M for medical and community needs around the globe.

Beyond the healthcare industry, MIT launched a hackathon for thousands of participants to build solutions for COVID-19, encompassing the protection of vulnerable populations and supporting health systems. The baseball manufacturing company Fanatics substituted the production of jerseys for PPE, as did the haute couture atelier Christian Siriano. The supermarket chain H-E-B is selling ready-made meals from restaurants to support the local economy. Jack Dorsey, the founder of Twitter and Square, will donate $1B worth of equity in Square to his Start Small LLC that funds global COVID-19 relief.

People are coming together to mitigate the impact COVID-19 on all of us. As a venture capitalist in biotech, focusing on good science has always been and continues to be the focus of my work and that of my peers throughout the industry. Companies working on me-too therapies or treatments based on mediocre science may no longer prosper.

COVID-19 has wreaked catastrophic damage and remains a multinational crisis. Things will get worse before they get better. But they will indeed get better with time, resources, and the combined effort of the global community.

By Principal Emi Gonzalez

Emi on Linkedin

Sources

- Creative Ways Companies Are Giving Back During The COVID-19 Crisis

- These 23 companies are working on coronavirus treatments or vaccines — here’s where things stand

- Biotech Stocks Face a Steep Drop

- The Ups And Downs Of Biotechnology

- Have a new drug that promises to fight Covid-19? The FDA promises fast action but some developers aren't happy

- Beyond borders 2016: Biotech financing

- This Downturn Will Be Different: What We Expect In A Recession Marred By Coronavirus

- Here’s What One VC Is Warning His Portfolio Companies About As Coronavirus Spreads

- Private-Equity Investors Try to Gauge Coronavirus Cash Crunch

- Private equity and venture capital will feel the effects of the coronavirus

- 10 big things: Life in America's coronavirus capital

- Why venture capital might avoid "fund size cuts" during coronavirus crisis

- General Catalyst Raises $2.3 Billion for Three Funds

- China's VC industry bounces back after coronavirus-induced winter

- Live coronavirus updates: Coronavirus effects on private markets